FMLA Fraud in Energy Operations: The Hidden Crisis Draining Your Budget and Compromising Safety

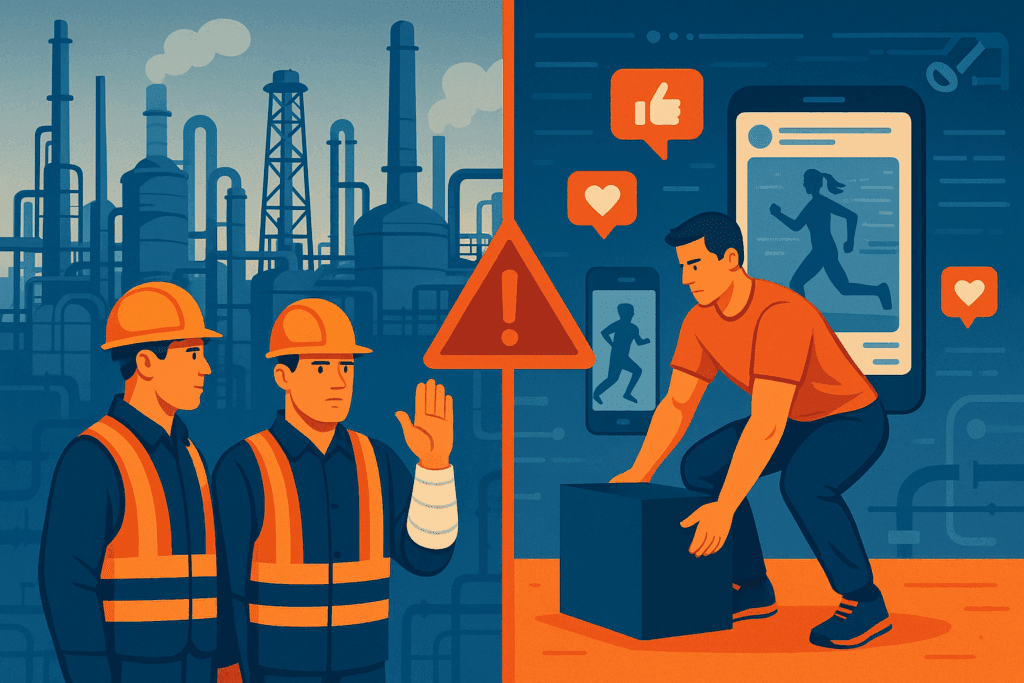

The statistics reveal a troubling reality: 66% of HR professionals acknowledge widespread FMLA abuse in their organizations. In energy operations, this fraud creates problems that extend far beyond lost productivity. When safety-critical positions sit empty due to fraudulent medical claims, operational integrity suffers and people can get hurt. Energy companies face a unique vulnerability to […]

The Person Stealing From Your Bank Sits Three Cubicles Down From HR

Last Tuesday, a regional bank president called our team. “We just discovered our head teller has been stealing from us for four years… how did we miss this?” Said bank had spent $2.3 million on cybersecurity upgrades in the past two years. State-of-the-art firewalls. AI-powered fraud detection. The works. Meanwhile, the head teller was skimming […]

The Cost of a Bad Hire: How Investigative Due Diligence Protects Companies

Hiring is one of the most critical decisions a company makes, directly impacting its bottom line, workplace culture, and legal standing. Yet despite best efforts, organizations often encounter the costly consequences of a bad hire. Whether it’s an employee who lacks the skills they claimed to have, engages in unethical behavior, or creates conflict within […]