Energy Sector Under Fire: How Insider Threats Are Sabotaging America’s Critical Infrastructure

America’s energy infrastructure is under unprecedented assault, and the most dangerous attacks aren’t coming from foreign hackers—they’re emerging from within the industry itself. Third-party breaches drive almost half (45%) of malicious intrusions in this sector, according to a joint study by SecurityScorecard and KPMG, but the insider threat landscape presents an even more complex challenge […]

Healthcare’s Security Epidemic: Why Hospitals Need More Than IT Solutions to Combat Rising Threats

Healthcare facilities are experiencing an unprecedented security crisis that extends far beyond the cyber attacks dominating industry headlines. While $133.5 million of confirmed payments were sent to ransomware groups in 2024, hospitals face an equally serious threat from within their own walls—one that no firewall can stop. Health care workers are five times more likely […]

Manufacturing’s $267,000 Problem: How Internal Threats Are Sabotaging Production Lines

Manufacturing facilities across America are under siege—not just from external cyber threats, but from a more insidious danger lurking within their own walls. The industries with the greatest median losses are mining ($550,000), wholesale trade ($361,000), and manufacturing ($267,000) when it comes to occupational fraud, according to the Association of Certified Fraud Examiners’ 2024 report. […]

When Attorneys Need Investigators: Critical Support Services for Law Firms

Let us tell you about a case that changed how we think about legal investigation. A personal injury attorney called us about a client claiming total disability from a workplace accident. The plaintiff’s medical records looked legitimate, his testimony was consistent, and the case seemed straightforward. But something felt off. The attorney’s gut instinct was […]

The $50 Billion Problem: Why Employee Theft Investigations Require Professional Expertise

Employee theft represents one of the most devastating yet underreported crises facing American businesses today. The numbers tell a sobering story: over $50 billion in annual losses, with 75% of employees admitting to stealing from their workplace at least once. Even more shocking, 95% of all businesses have experienced employee theft, making this a virtually […]

The Hidden Crisis: Why Healthcare Organizations Need Professional Workplace Investigations

Working in healthcare means dealing with life-and-death situations daily. But there’s another crisis brewing behind hospital doors—one that threatens patient safety, destroys careers, and costs healthcare systems millions. I’m talking about workplace misconduct that goes far beyond typical office drama. After investigating hundreds of cases in medical facilities, we’ve seen how quickly things can spiral […]

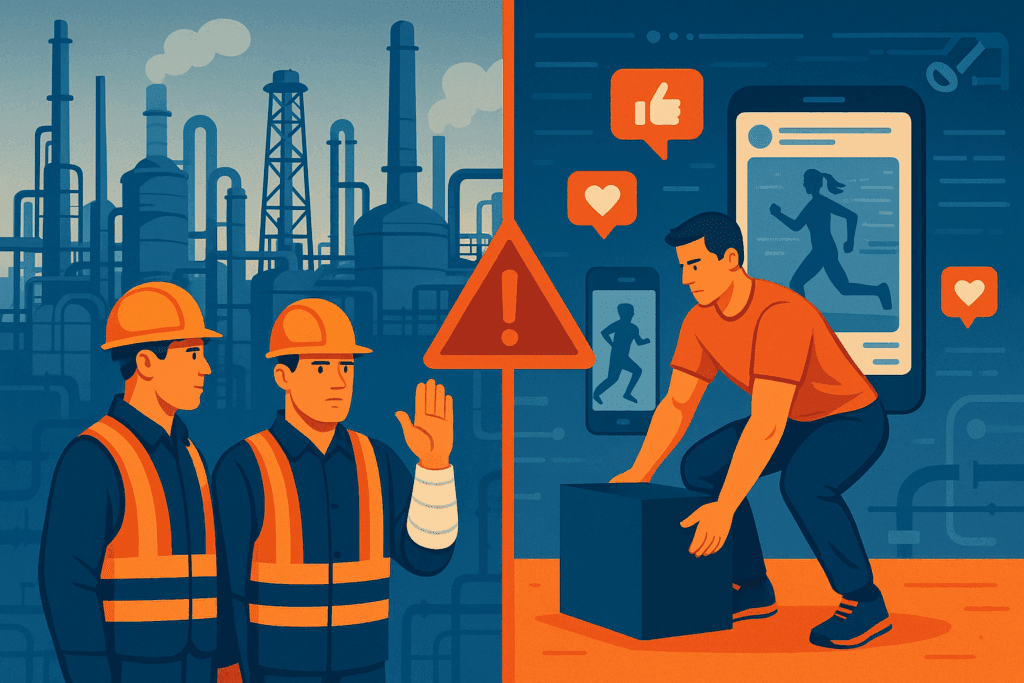

FMLA Fraud in Energy Operations: The Hidden Crisis Draining Your Budget and Compromising Safety

The statistics reveal a troubling reality: 66% of HR professionals acknowledge widespread FMLA abuse in their organizations. In energy operations, this fraud creates problems that extend far beyond lost productivity. When safety-critical positions sit empty due to fraudulent medical claims, operational integrity suffers and people can get hurt. Energy companies face a unique vulnerability to […]

The Person Stealing From Your Bank Sits Three Cubicles Down From HR

Last Tuesday, a regional bank president called our team. “We just discovered our head teller has been stealing from us for four years… how did we miss this?” Said bank had spent $2.3 million on cybersecurity upgrades in the past two years. State-of-the-art firewalls. AI-powered fraud detection. The works. Meanwhile, the head teller was skimming […]

Workplace Violence Threats: Prevention, Detection, and Response Strategies

Workplace violence is a growing concern for organizations worldwide, encompassing a range of harmful behaviors, from physical assaults and verbal threats to digital harassment and intimidation. According to the Occupational Safety and Health Administration (OSHA), nearly two million workers report being victims of workplace violence annually in the United States alone. The Bureau of Labor […]

The Cost of a Bad Hire: How Investigative Due Diligence Protects Companies

Hiring is one of the most critical decisions a company makes, directly impacting its bottom line, workplace culture, and legal standing. Yet despite best efforts, organizations often encounter the costly consequences of a bad hire. Whether it’s an employee who lacks the skills they claimed to have, engages in unethical behavior, or creates conflict within […]