Energy Sector Under Fire: How Insider Threats Are Sabotaging America’s Critical Infrastructure

America’s energy infrastructure is under unprecedented assault, and the most dangerous attacks aren’t coming from foreign hackers—they’re emerging from within the industry itself. Third-party breaches drive almost half (45%) of malicious intrusions in this sector, according to a joint study by SecurityScorecard and KPMG, but the insider threat landscape presents an even more complex challenge […]

Healthcare’s Security Epidemic: Why Hospitals Need More Than IT Solutions to Combat Rising Threats

Healthcare facilities are experiencing an unprecedented security crisis that extends far beyond the cyber attacks dominating industry headlines. While $133.5 million of confirmed payments were sent to ransomware groups in 2024, hospitals face an equally serious threat from within their own walls—one that no firewall can stop. Health care workers are five times more likely […]

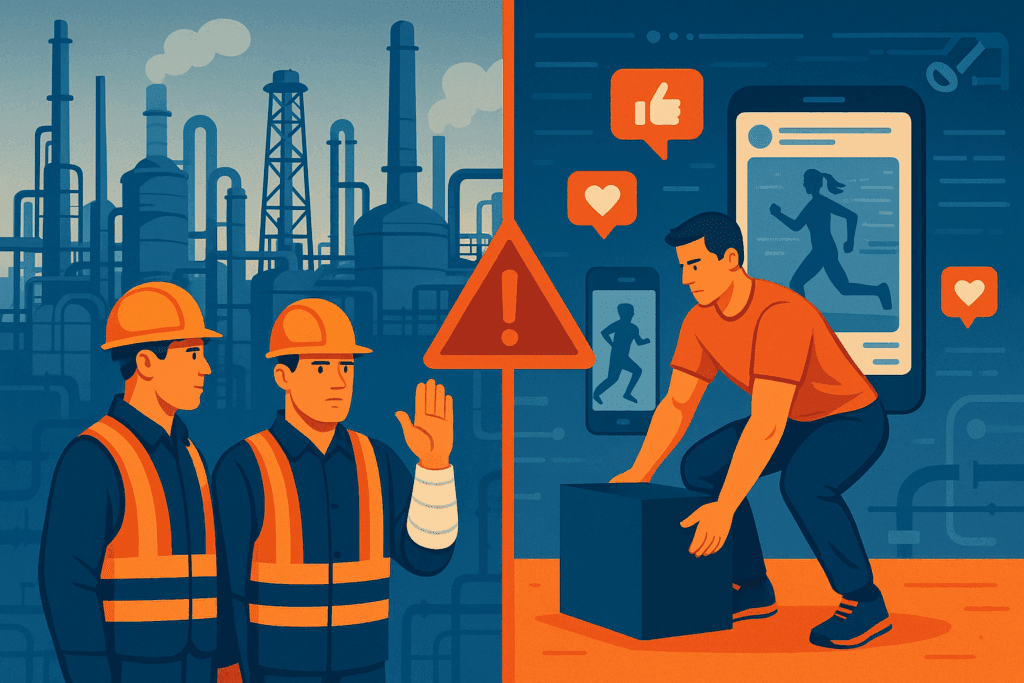

Manufacturing’s $267,000 Problem: How Internal Threats Are Sabotaging Production Lines

Manufacturing facilities across America are under siege—not just from external cyber threats, but from a more insidious danger lurking within their own walls. The industries with the greatest median losses are mining ($550,000), wholesale trade ($361,000), and manufacturing ($267,000) when it comes to occupational fraud, according to the Association of Certified Fraud Examiners’ 2024 report. […]

The Hidden Crisis: Why Healthcare Organizations Need Professional Workplace Investigations

Working in healthcare means dealing with life-and-death situations daily. But there’s another crisis brewing behind hospital doors—one that threatens patient safety, destroys careers, and costs healthcare systems millions. I’m talking about workplace misconduct that goes far beyond typical office drama. After investigating hundreds of cases in medical facilities, we’ve seen how quickly things can spiral […]

FMLA Fraud in Energy Operations: The Hidden Crisis Draining Your Budget and Compromising Safety

The statistics reveal a troubling reality: 66% of HR professionals acknowledge widespread FMLA abuse in their organizations. In energy operations, this fraud creates problems that extend far beyond lost productivity. When safety-critical positions sit empty due to fraudulent medical claims, operational integrity suffers and people can get hurt. Energy companies face a unique vulnerability to […]

Are Your Background Checks Missing Red Flags? Why Third-Party Investigations Matter

When it comes to hiring new employees, most organizations rely on standard background checks. These typically include verifying employment history, running criminal record searches, and confirming education credentials. While these checks are valuable, they often fail to uncover deeper, more nuanced risks-like a history of financial fraud, patterns of domestic abuse, or past involvement in […]

Uncovering Hidden Assets in Divorce Cases

One of the most conflicting aspects of divorce—which is typically an emotionally and financially complicated process—is asset distribution. Although courts want both sides to be open about their financial situation, it is not unusual for one spouse to try to conceal assets to prevent equitable division. Whether it’s secret property holdings, covert business income, or […]

Workplace Investigations in 2025: What Employers Need to Know

Workplace investigations are evolving in 2025 with new laws and shifting workplace cultures. Learn how employers can navigate these changes and ensure compliance.

Avoiding the Trap of Romance Scams: Protect Yourself or Loved Ones from Financial Loss

Romance scams have become a global problem, resulting in heartbreak and financial loss. In fact, according to the Federal Trade Commission, consumers lost $1.14 billion to romance scams in 2023. The typical victim lost $4,400—an amount that could completely ruin many emotionally and financially—as scammers employ ever more advanced strategies. Knowledge of these frauds is […]

Resolving Custody Disputes Before the Holidays

Often a celebration of happiness and togetherness, the holidays can prove especially difficult for families negotiating custody issues. The U.S. Census Bureau estimates that there were around 10.9 million one-parent households with children under the age of eighteen, with eighty percent of these households maintained by mothers. This emphasizes how often custody issues arise around […]