The Person Stealing From Your Bank Sits Three Cubicles Down From HR

Last Tuesday, a regional bank president called our team. “We just discovered our head teller has been stealing from us for four years… how did we miss this?” Said bank had spent $2.3 million on cybersecurity upgrades in the past two years. State-of-the-art firewalls. AI-powered fraud detection. The works. Meanwhile, the head teller was skimming […]

Preventing Financial Fraud: Strategies for Individuals and Businesses

Financial fraud – two words that strike fear into the hearts of individuals and businesses alike. In today’s world, where digital transactions and complex financial systems reign supreme, the risk of falling victim to fraudulent activities is higher than ever. From identity theft and credit card fraud to elaborate Ponzi schemes and insider trading, the […]

Safeguarding Your Workplace: Strategies to Prevent Theft and Fraud.

This is how workplace investigations can prevent fraud in your business

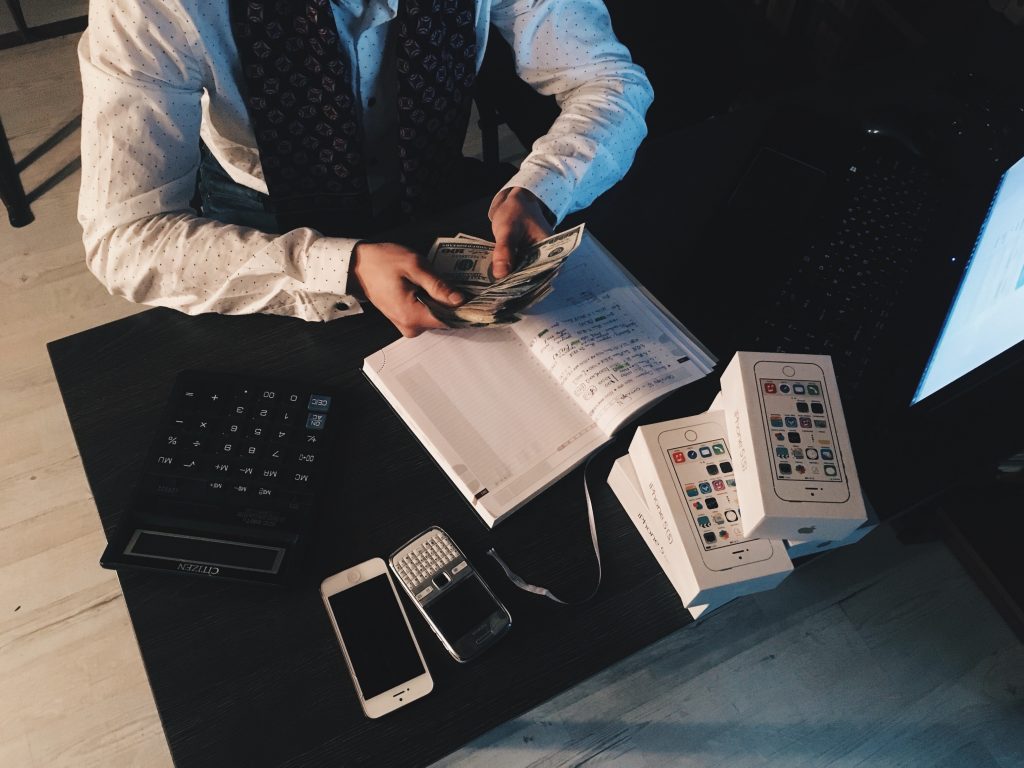

Employee fraud is common, especially in small and medium-sized businesses. It involves fraudulent activities such as stealing from your organization, deceiving your employer, or illegally gaining financial favor or personal benefits. According to one study, about 46% of organizations have admitted to experiencing fraud in the last two years. While fraud can stem from other […]

Embezzlement: How to Proceed Following Fraud

Your business is your livelihood. It’s what you’ve poured your blood, sweat, and tears into establishing. So it can be very devastating to suddenly find out that your accountant has run away with your company’s money. You can actually feel like a rug has been pulled out from under you. Accountants can steal money for […]

How to Protect Your Business Against Small Business Fraud, Embezzlement, and Workplace Theft

Do you have adequate measures in place to protect yourself from the perils of small business fraud, embezzlement, and workplace theft? Far too many businesses don’t realize that the biggest threat to their success is usually standing next to them. In fact, in the world of enterprise, 90% of all significant theft losses come from […]

Top 5 Types of Corporate Fraud

When it comes to protecting your business from the myriad of frauds that occur in U.S. workplaces every single day, being informed is the first step. Our private investigators are here to help you recognize these top five types of fraud in business so they can be stopped as soon as possible. Payroll Fraud […]

Keeping Construction Honest: Investigating Fraud and Forgery

Given the increasing economic turbulence felt globally in 2022—thanks to factors such as the Covid-19 pandemic and unfolding energy crisis—it comes as no surprise that fraud is on the rise. Even the construction industry is not impervious to these impacts. In fact, the complexities of numerous cost outputs, suppliers, and subcontractors mean that it has […]

Are Members of Your Crew Malingering? Get Answers With a Private Investigator

Being able to rely on your crew operating like a well oiled machine is the difference between profit and loss for your business. When the team is cohesive, mountains can be moved and your investments are sure to pay off. But what happens if you begin to suspect a member of your crew is malingering […]

Intellectual Property Theft: Don’t Let Your Greatest Assets Slip Away

When thinking about the security of your business, it’s easy to place focus on brick and mortar assets, valuable inventory, and carefully counted financials. However, there is another area of your business that needs to be protected at all costs. As the FBI confirms, intellectual property theft robs unsuspecting U.S. businesses of billions of dollars […]