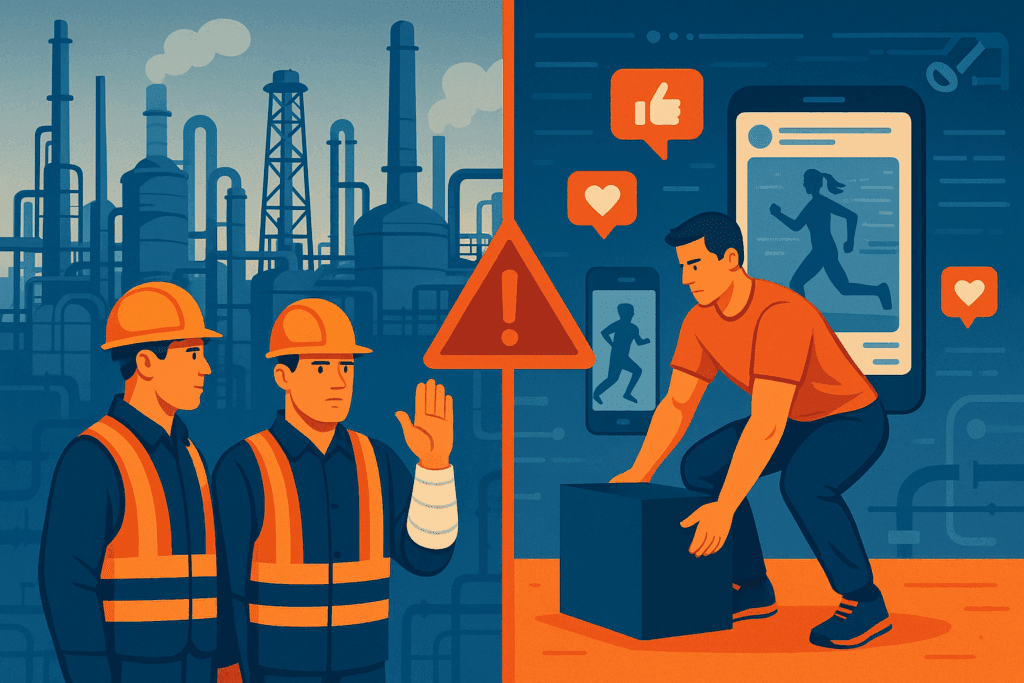

FMLA Fraud in Energy Operations: The Hidden Crisis Draining Your Budget and Compromising Safety

The statistics reveal a troubling reality: 66% of HR professionals acknowledge widespread FMLA abuse in their organizations. In energy operations, this fraud creates problems that extend far beyond lost productivity. When safety-critical positions sit empty due to fraudulent medical claims, operational integrity suffers and people can get hurt. Energy companies face a unique vulnerability to […]

The Person Stealing From Your Bank Sits Three Cubicles Down From HR

Last Tuesday, a regional bank president called our team. “We just discovered our head teller has been stealing from us for four years… how did we miss this?” Said bank had spent $2.3 million on cybersecurity upgrades in the past two years. State-of-the-art firewalls. AI-powered fraud detection. The works. Meanwhile, the head teller was skimming […]

5 Things to Do If You Suspect Someone Is Lying to You

When your team or yourself have the feeling that someone is not being honest with you it can be unsettling. Corporate theft is a serious issue, costing American companies billions of dollars every year. About a third of a time, these cases of theft are from high level managers. No matter the details of […]

How to Prevent Employee Theft at Car Dealerships

[et_pb_section fb_built=”1″ _builder_version=”3.22″][et_pb_row _builder_version=”3.25″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.25″ custom_padding=”|||” custom_padding__hover=”|||”][et_pb_text _builder_version=”3.27.4″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]Neighborhood car dealerships are often a victim of theft in many formats. For Lauth Investigations investigators there appears to be an uptick in handling these cases. Employee theft is common in general, with 50 billion dollars lost annually to employee theft […]